Payback period calculator online

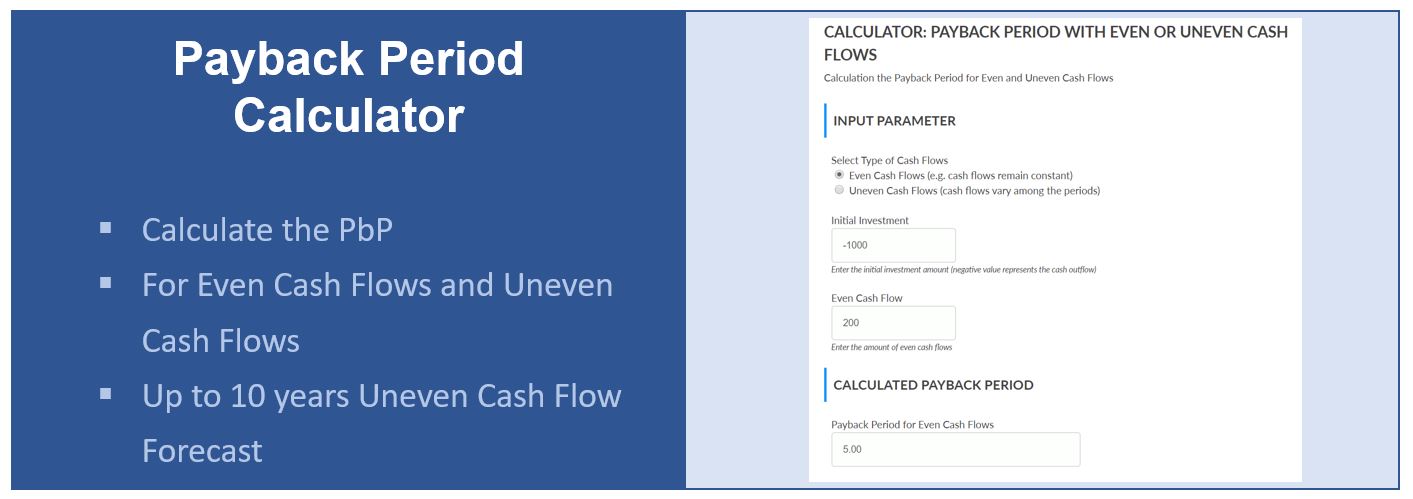

Date on which back pay interest stops accruing. The Payback Period PBP Calculator Even and Irregular Cash Flows Fill in the required values ie.

Discounted Payback Period Formula And Calculator Excel Template

DPP refers to the year-long discounted payback period.

. It is the time period where the investment cash outflow starts recovering from investment cash inflows. About the Calculator Features. The formula to calculate even payback period is given below.

Number of days between end of pay period and date that paychecks are issued. Want to know how many days after your period do you ovulate. The length of time YearsMonths needed to recover the initial capital back from an investment is called the Payback Period.

Formula for Calculating Payback Period. Calculating the payback period in this calculator is a fairly straightforward process. Payback Period Calculator Payback period is a simple technique for measuring the investment appraisal.

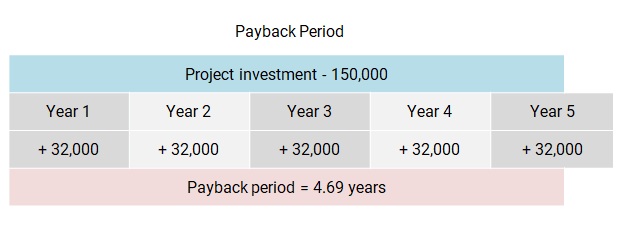

Pay Periods and Interest. By Gary Jeffrey - Last Updated. Payback Period 1 million 25 lakh Payback Period 4 years Explanation The payback period is the time required to recover the cost of total investment meant into a business.

R refers to the discount rate. The DPP is X YZ 3 -1296018 2390547 354 years. From that we can derive the discounted cash flows on a cumulative basis.

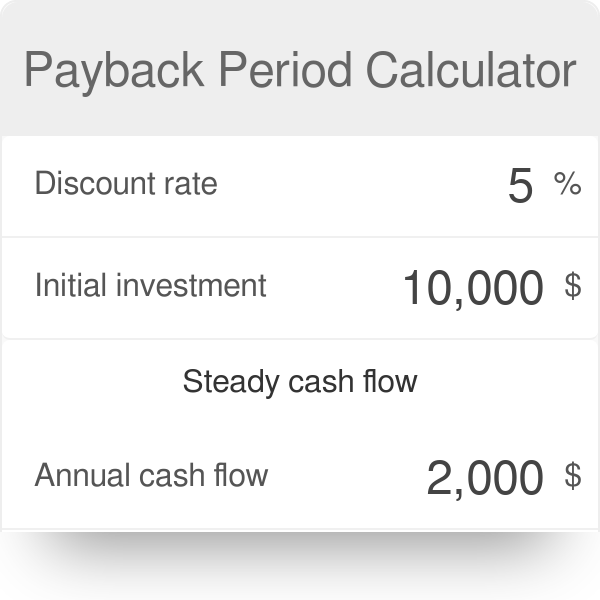

Payback Period Calculator. Ad Track your ovulation in Flo to get more accurate period predictions with irregular periods. The payback period is the amount of time it takes to recoup the investment capital.

I refers to the sum that you have invested. Number of days in employees pay period. The online payback period calculator lets you calculate the payback periods with discounts estimate your average returns and schedules of investments.

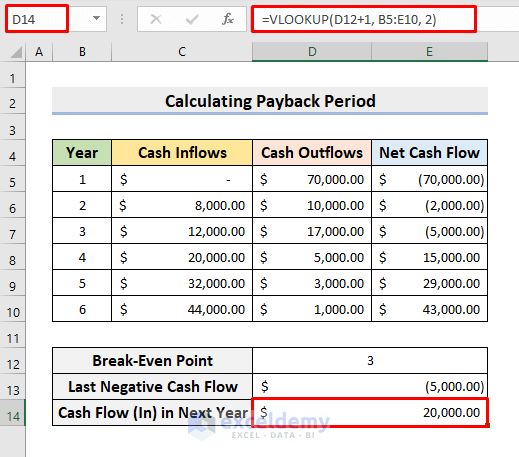

Heres a simple payback period formula when cash flows are equal each year. Our below online payback period calculator helps you calculate payback period instantly. Step by Step Procedures to Calculate Payback Period in Excel.

The tool updates automatically and shows you the expected payback period for your series of cash flows. The Discounted Payback Period is. Type the yearly cash flows comma or space separated.

Cash flow is the inflow and outflow of currency. Payback Period with Regular or Irregular Cash Flows. Using the Payback Period Formula We get- Payback period Initial Investment or Original Cost of the Asset Cash Inflows.

First day of first pay period for which back pay is payable. The Payback Period PbP or PBP indicates the period in which a full repayment or amortization of an investment is achieved. Use this Payback Period Calculator to compute the Payback Period PP P P of a stream of cash flows by indicating the yearly cash flows F_t F t starting at year t 0 t 0.

First day of last pay period for which back pay is payable. This indicator is used not only for the assessment of project options and business cases in project management but also for the assessment of investment alternatives. Fixed Cash Flow Irregular Cash Flow Each Year Related Cash Flow Cash flow is the inflow and outflow of cash or cash-equivalents of a project an individual an organization or other entities.

An increase in cash indicates an increase in assets while a negative value denotes incurred expenses. Also this discounted payback period calculator estimates the cumulative cash flow discounted cash flow and cash flow of each year. A shorter payback period is more lucrative in the case of investments contrary to more extended payback periods.

C refers to the annual cash flow - how much you earn. Use Flo and track your cycle. Select whether you are projecting even or uneven cash flows fill in the initial.

Quit worrying as you can calculate the results from fixed or irregular cash flow each year. The DCF for each period is calculated as follows - we multiply the actual cash flows with the PV factor. Both the payback period as well as discounted payback period is used widely and can be understood quite easily.

R refers to discount rate. The payback period can be calculated by dividing the initial investment from the total annual cash flow. Payback Period Calculator is an online tool that calculates the result effortlessly by simply entering the.

DPP - ln1 - IRCln1 R Here DPP refers to Discounted Payback Period while I is the investment amount and C is annual cash flow. The Payback Period Calculator can calculate payback periods discounted payback periods average returns and schedules of investments. This is a capital budgeting term.

Payback Period Initial investment Total annual cash flow from the project. DPP - ln 1 - I R C ln 1 R Where. This payback period calculator solves the amount of time it takes to receive money back from an investment.

The initial investment and the projected net cash flows. Calculate the Payback Period in years. It provides the number of years it takes to earn back again the initial investment from undertaking the expenditures like discounting the cash moves and.

Here is the formula for discounted payback period. Payback Period Initial Investment Net Cash Flow Per Year. Enter the initial investment amount and the cash flow into the calculator and press calculate.

How To Calculate Payback Period In Excel With Easy Steps

Payback Period Business Tutor2u

Payback Period Calculator Pbp For Even Uneven Cash Flows Project Management Info

How To Calculate The Payback Period With Excel

Payback Period Formula And Calculator Excel Template

Payback Period Formula And Calculator Excel Template

Payback Period Pbp Calculator Regular Varying Cash Flows Calculate Online

Payback Period Calculator

How To Calculate The Payback Period With Excel

Calculate The Payback Period With This Formula

Payback Period Calculator Efinancemanagement

Discounted Payback Period Formula And Calculator Excel Template

Discounted Payback Period Formula And Calculator Excel Template

How To Calculate The Payback Period With Excel

Payback Period Calculator Find Payback Period With Formula

How To Calculate Payback Period Formula In 6 Min Basic Tutorial Lesson Review Youtube

Payback Period Calculator Double Entry Bookkeeping